We often complain that we do not have the money to do certain things like travel or buy a car or even save for our kid’s education. Sometimes, we look at others and wonder how they can afford to do so many things. Well, the answer is savings.

This article will give you an insight into what happens to your hard-earned money, where your major share of income gets totally wasted, and how you can help or manage your finances well.

Here are few tips to save money and fix these ‘leaks’:

1. Make a budget

Making a budget helps locate where all the finances go. Your budget should help to summarize how your expenses measure up to your income. This will help control overspending. Also make sure to chart up all the expenses which occur regularly but not every month, like car insurances.

2. Differentiate between want and need

Though it is easier said than done, it is a great way of saving money. If you can differentiate between what you need versus what you want then you can save a lot of money. For example: Don’t buy a new Smart TV only because Mrs. Sharma next door got one when your old one is working just fine.

3. Keep a tab on where you spend

The key to saving is to keep a tab on where you spend your money. Keep track of your income, where most of the expenses go and how you can minimize your expenditures. You can do it manually or there are some great expense tracking apps.

4. While shopping, shop intentionally

When you go shopping list all the things that you need. If a particular thing is not on your list, chances are that you do not need the thing and hence, there is no point in buying it.

5. It’s better to pay by cash rather than by card

For smaller expenses, it may be better to pay by cash, than by card. This may sound strange, but we tend to lose track of expenses while paying by card rather than by cash. When you pay by cash you keep a check on how much money you are spending. While paying by card you may not have any idea how much money you spend until you have the account statement/credit card bill in hand.

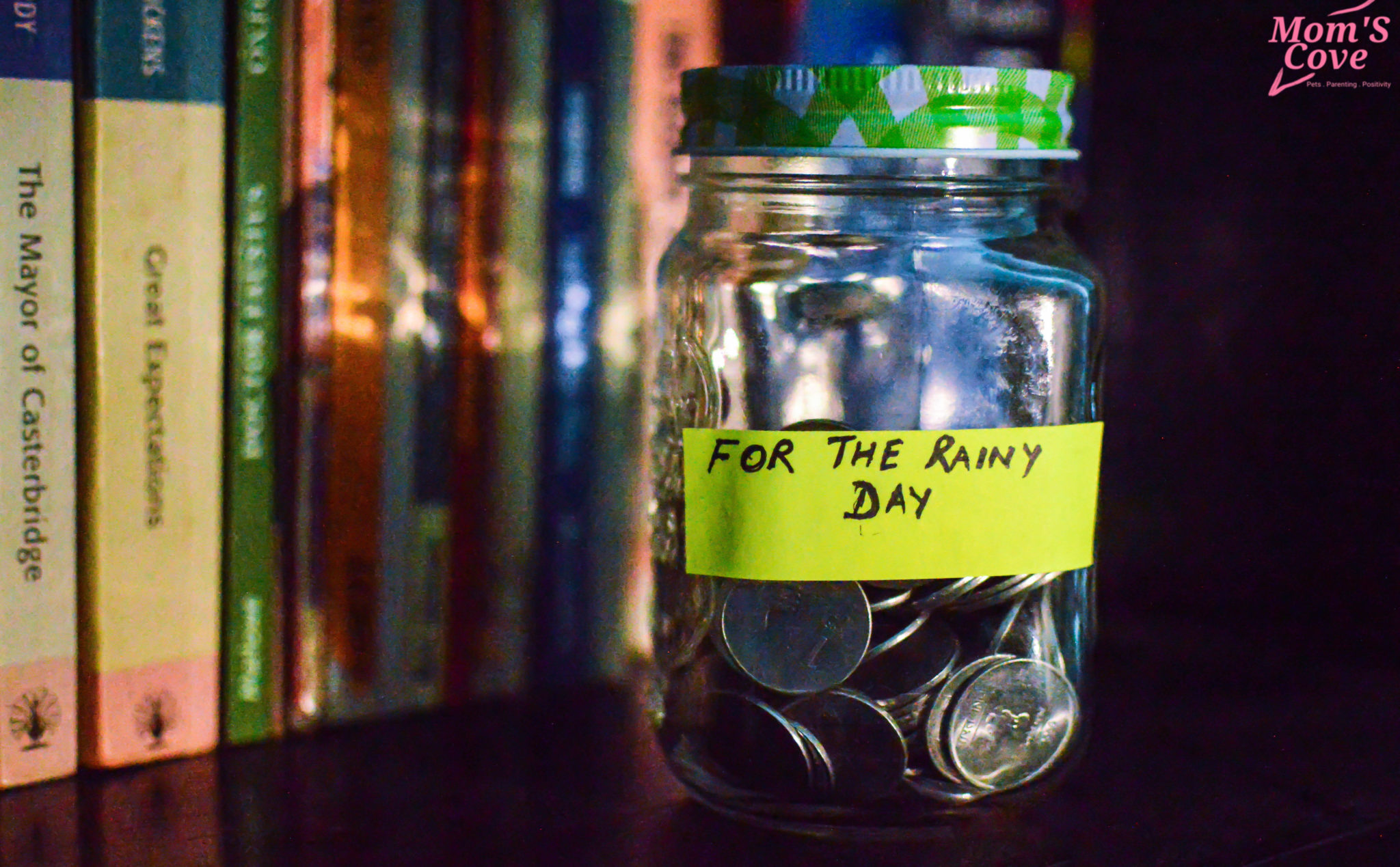

6. Save regularly

Inculcate the habit of saving a little every month. Your budget will tell you how much money you require each month. You need to calculate how much money you require to run the entire month, then it becomes clear as to how much you should be able to save. Once you have decided to save some money and have calculated the amount you expect to save, saving money should be a piece of cake, right?

Wrong! Remember that money can be quite slippery. If you have excess cash in hand, you could easily overspend your budget. To overcome this problem set aside your desired amount for saving at the beginning of the month. The amount available for expenditure = Total income – savings. Not the other way round. Also, remember to have an emergency corpus…just in case

7. Make your savings goal-oriented

We all have certain financial goals in life. Say, we need to save for the down payment of our next car after three years or you may like to save for a foreign trip. You may have long-term goals like your dream home or your child’s education. Linking your savings to these goals can be a great impetus. When you set a goal for saving money like education, marriage, vacation, child’s education, or retirement, you tend to figure out how much money you will need and how long it might take for you to save it.

8. When buying things learn to compare

This tip might help you in a lot of ways. If you need to buy something, don’t buy it right away. It’s best that you look for options from other places where you can get it in much more reasonable rates. E-commerce platforms like Amazon may offer you great bargains. By comparing things online, you will not only have an idea of the actual cost of the product, thereby getting the same thing at a much cheaper rate.

9. Save money by keeping yourself healthy

This may not directly reflect on your savings but none the less it’s an important factor. When you eat well and are healthy, the chances of you being sick slope down, which in turn reduces your medical bills to a large extent. So you see keeping yourself fit and healthy does contribute to saving. Also, get medical insurance and save your medical bills from eroding your savings.

10. Use Discounts and sales in your favor

Nowadays channels are abundant with choices each giving discounts or hauls on your favorite things. Though discounts sale could be good bargains, don’t let discounts tempt you. For example, if you bought something worth 1000 rupees at a 40% discount, you saved 400 rupees. But, if that thing was not essential and the heavy discount prompted you to buy it, you may have actually lost 600 rupees which could have gone to your savings. Learn to say that I don’t need it now. This might make you cringe but learning to say that you don’t need it will do wonders for your finances which no financial planner can provide.

These tips to save money are probably not new to you as homemakers. But the importance of small savings is seldom appreciated. If you are already doing it, then this article will be yet another push. If not, then your time starts now. Involving children in the process of budgeting and saving will gradually prepare them for their future. Remember, little drops of water make the mighty ocean.

Did you find it useful? please let us know in the comments below. Don’t forget to share

Leave a Reply